🏗️ For LPs evaluating new VC managers: my 2x2 framework

Aligning vision with readiness when backing first-time VC funds (micro ones in particular)

This is probably the longest piece I’ve ever written on Venture Notes, but one of the most actionable articles of this newsletter to date. If you want to chat about how to implement and adapt this 2x2 framework to your strategy, or share your convictions/frustrations in this market as a new/emerging LP in VC, you can simply reply to this email.

During my time as a Venture Capital Researcher at IMD between 2023 and 2024, I fell deeply into academic thinking about the topic, and really enjoyed taking a step back. Prior to that, I graduated from VC Lab (Cohort 6, now preparing to launch Cohort 18) while simultaneously embarking on the journey of raising a first-time micro VC fund (under the $25M category). And along the way, several pivotal insights emerged.

By blending academic research, thoughtful conversations, constructive LP feedback, and hands-on experience in fundraising, I developed a practical framework tailored for new/emerging LPs with limited VC experience to evaluate new VC managers with micro first-time funds. This framework is designed to guide their decision-making process effectively.

And now, here we are.

Evaluating new VC managers raising (micro) first-time funds

Qualitative > Quantitative. But how to evaluate?

Investing in new, first-time VC managers raising their debut micro funds presents unique opportunities and challenges for Limited Partners (aka LPs). Unlike established funds with extensive track records, new managers often lack historical performance data (were angels, or couldn’t get track attribution at their prior VC firm because too young for instance) but bring something fresh.

For LPs, the decision to invest in such funds requires a nuanced approach that balances qualitative and quantitative factors, with a lot of emphasis on the former. This research introduces a 2x2 framework to guide new and emerging LPs in evaluating first-time VC managers, emphasizing the interplay between manager readiness and LP alignment.

The new VC manager landscape

For context, first-time managers matter in venture because they offer distinct “advantages”:

fresh perspectives: they often explore underrepresented markets or sectors, bringing innovative approaches to deal sourcing and portfolio management

motivation and engagement: new managers are highly motivated to build a strong track record, often investing significant personal capital ("skin in the game") OR obliterating a fancy lifestyle based mostly on fat nominal management fees (2% on a micro-fund in nominal money terms does not allow for a fancy lifestyle at all)

focus on niche opportunities: many micro funds target early-stage startups that larger funds often overlook, offering LPs exposure to highly differentiated ecosystems and investment theses

Yet, challenges for first-time VC managers are numerous. Despite their “advantages”, first-time managers face several hurdles such as:

limited track record: LPs often struggle to assess performance due to a lack of historical data.

operational complexity: setting up robust infrastructure for compliance, reporting, and portfolio management can be daunting for new managers! I can confirm.

competition for deals: still, new managers might compete with established firms with brand power for access to top-tier startups

The 2x2 framework, tailored to evaluating new VC managers

To help new/emerging LPs navigate this tough exercise, I have designed a high-level 2x2 framework to evaluate first-time VC managers based on what I believe are the two most critical dimensions:

X-axis: “manager readiness”

This dimension assesses the new VC manager's preparedness to execute their investment strategy effectively. Key indicators include:

domain expertise and sector knowledge

a clear and differentiated investment thesis

strong professional networks for deal sourcing (and follow-on funding although the latter is a highly disputable topic)

operational infrastructure to support fund management and compliance

Y-axis: “LP alignment”

This dimension evaluates how well the new VC manager's goals align with the new and emerging LP's investment strategy and expectations. Key factors include:

shared values and long-term vision

compatibility in risk appetite and return expectations

transparency and communication style

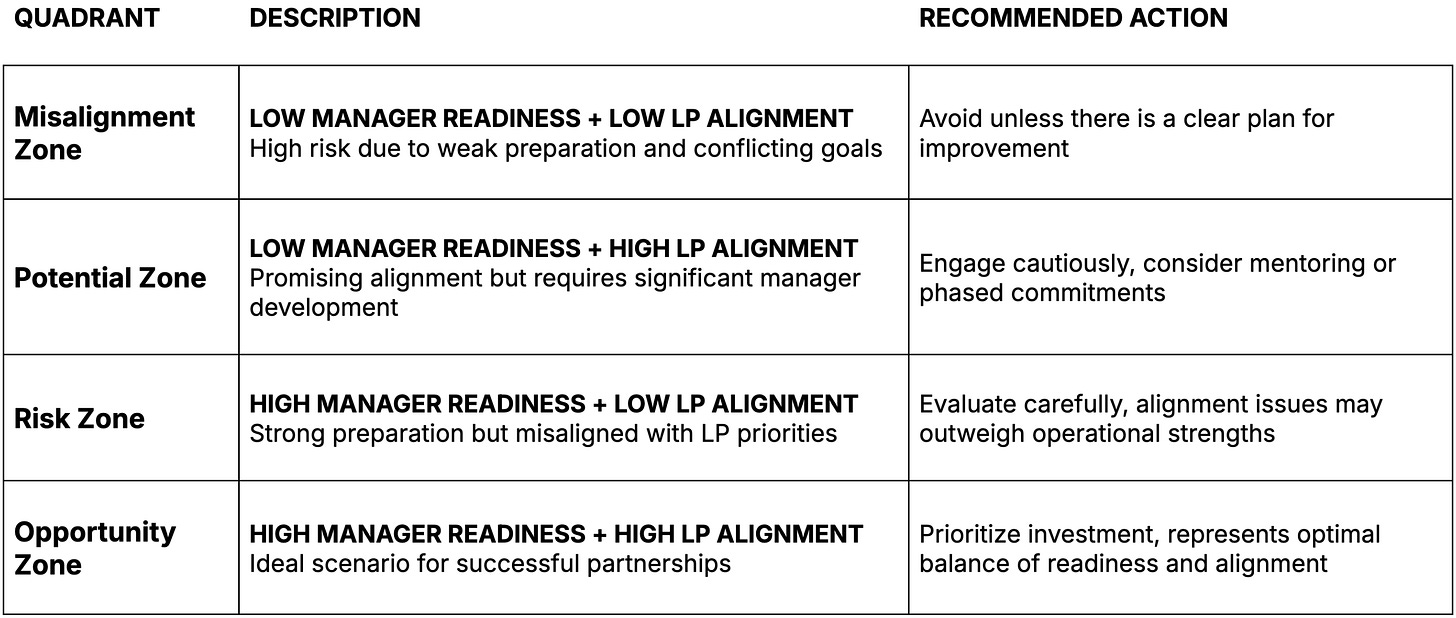

The four quadrants

The intersection of these two dimensions (LP alignement, manager readiness) creates four quadrants, hence a “2x2 framework“, each representing a different scenario:

Clarifying the "Risk Zone" in my 2x2 framework: VC by its very nature is a high-risk asset class. Within the context of this 2x2 framework, the "Risk Zone" has a more specific meaning that goes beyond the general riskiness of VC. It refers to situations where a new VC manager demonstrates high operational readiness but lacks alignment with a particular new/emerging LP’s investment strategy, priorities, or values. This misalignment introduces a unique type of risk: relational risk.

Practical application

This 2x2 framework should be simple enough to be leveraged to any new/emerging LPs’ peculiar context.

Here is how LPs can use the framework:

early screening: use the framework during initial meetings to categorize potential investments

due diligence focus: tailor due diligence efforts based on the quadrant (e.g., focus on operational gaps in the “Potential Zone”)

decision-making support: combine this framework with other tools like flag systems or checklists for a comprehensive evaluation

✅ But who should use it?

new and emerging LPs seeking guidance on evaluating emerging managers

institutional investors exploring diversification through micro funds and new managers in VC

advisors helping LP clients identify high-potential first-time managers in VC

❌ Who shouldn’t use it..

experienced LPs focused exclusively on established VC funds with extensive track records

investors / LPs with narrow VC mandates that require highly specific criteria not addressed by this 2x2 framework

If you fall in any of the above ✅ categories, I invite you to use and test this framework

Ok, it is not really a spoiler that investing in first-time VC managers raising micro funds is both an art and a science. The proposed 2x2 framework provides a structured approach for new and emerging LPs to evaluate new VC managers holistically, balancing qualitative factors like alignment with quantitative indicators of readiness.

By adapting this framework alongside traditional due diligence approches, new and emerging LPs can make more informed decisions about which first-time VC managers to back. Ultimately, those who identify strong candidates in the "Opportunity Zone" stand to benefit from both superior financial returns and meaningful contributions to the venture ecosystem. You might also want to build rapport with the new VC managers falling in the three other types of zone because of the long term nature of VC and opportunity for alignments eventually converging as 1) they do more closes of the same fund, or 2) raise subsequent funds. How to? At least by asking to be subscribed to their newsletter.

Where we believe Olive Capital is, in this 2x2 framework

In the context of this 2x2 framework, Olive Capital exemplifies a firm positioned in the right-hand side, in high manager readiness area. Our founding team has set up institutional-grade ops that belies our first-time fund status (admin, governance, and reporting standards). With deep domain expertise in GTM Enterprise, Product, scaling to Series B and VC-readiness, as well as media strategies, combined with extensive networks within the crypto ecosystem, we provide to forward-thinking LPs an compelling balance of vision and operational readiness, precisely the type of new manager that can deliver meaningful contributions to the venture ecosystem beyond web3.

However, we could sit either in the “Opportunity Zone” or in the “Risk Zone”: what’s left for the new/emerging LPs to identify is their alignment (as a reminder, this is 1. shared values and long-term vision, 2. compatibility in risk appetite and return expectations, and 3. transparency and communication style).

New VC firm on the right-hand side of the X-axis (“manager readiness”), all have operational power and clarity of voice.

Where is the fundraising market for new GPs heading to in the coming 12-18 months?

This sounds like a piece of advice to new GPs but this is actually what I believe new/emerging LPs should focus on, while implementing and adapting the 2x2 framework.

LP capital will probably get more scarce but will not disappear. The difficulty is going up, but the door is not closing. LPs (incl. new/emerging ones) will deploy, hopefully thanks to our 2x2 framework, but only to new managers who behave like institutions, not VC side-gigers. First-time funds with conviction, clarity of thoughts, and real differentiation will still raise. Every other GPs will either plateau, delay, or quit.

The power law is also applicable to VC fund fundraising, and will magnify gaps. Such above-mentioned new VC managers will raise faster, and attract capital that previously went to ok-ish funds / new GPs during up-only markets. This concentration creates a divide between 1) tier-1 new managers benefitting from a flywheel of easier fundraising, and better visibility/deal access, and 2) undifferentiated first-time funds having hard time to attract capital. Successful new GPs will be those clearly articulating why their approach offers distinctive value in a market becoming increasingly competitive.

Finally, we believe that Adam Metz is right, that platform emerges as the new performance metrics. Operational infrastructure will challenge returns in new/emerging LP evaluations of new GPs’ track. In other words, the perception of operational maturity even at first-time funds, will matter as much as past/actual/paper returns, especially for new managers without extensive track records and close to no DPI.

If you want to chat about how to implement and adapt this 2x2 framework to your strategy, or share your convictions/frustrations in this market as a new/emerging LP in VC, you can simply reply to this email.

Speak soon,

Raph Grieco